On April 17, 2022, Mexico’s Chamber of Deputies stopped President Andrés Manuel López Obrador’s initiative for constitutional amendment in electricity matters. The President’s proposal, designed to drastically limit the participation of private companies in the country’s electricity sector, was clearly rejected by lawmakers who did not give it the number of votes required for a constitutional amendment.

Main changes proposed in the energy amendment:

Furthermore, the transitory articles of the proposed constitutional amendment established that the Federal Electricity Commission (“CFE”) would have to develop at least 54% of the energy required in Mexico, while the private sector could only participate up to 46% in the generation of energy. Currently, the CFE and the private sector contribute 38% and 62%, respectively, in electricity generation, according to official sources.

VTZ is of the opinion that the constitutional amendment was aimed at legitimizing the Amendment of the Electricity Industry Law of 2021 as well as the current measures of the Mexican government to displace private investments and increase CFE’s participation in the electricity generation market. Although the constitutional amendment initiative was not approved, foreign investors (and even governments) could still resort to dispute resolution mechanisms provided in the treaties.

Lithium and the Amendment of the Mining Law

It should be noted that a few days following the rejection of the initiative for constitutional amendment in electricity matters, the Chamber of Deputies and Senators approved an amendment to the Mining Law, which was published in the Official Gazette on April 20, 2022, and entered into force on April 21, 2022.

The amendment of the Mining Law establishes that lithium is of “public utility” and, therefore, it is forbidden to grant to private companies concessions, licenses, or permits for the production of lithium. This reform also proposes that lithium will be “exploited” by a sort of state-owned company (“SOE”).

Implications for Mexico:

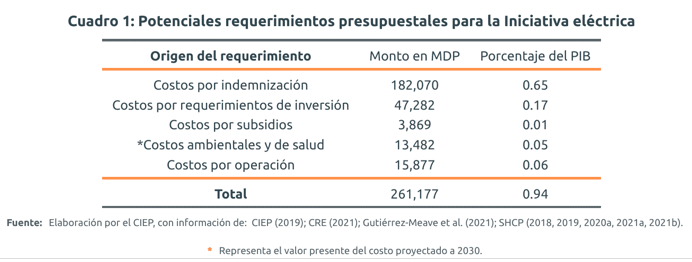

According to a Mexican NGO, Centro de Investigación Economica y Presupuestaria, A.C, if the constitutional electricity amendment had been approved, the Mexican government would have had to allocate 0.65% of its 2022 GDP (182 billion pesos) to compensate private companies.

“The initial costs derived from compensation, operation, investment, subsidies and health costs could represent 0.94% of {Mexico’s} GDP in 2022. This amount represents a third of the budget allocated to health in 2022 and 80% of the budget to public security.”

Implications for the United States:

Before the Chamber of Deputies voted on the proposed amendment, U.S. Trade Representative Katherine Tai (“USTR”) expressed concern about developments in the Mexican energy sector. In fact, the media reported that on March 31, 2022, USTR issued a letter addressed to the Mexican Minister of Economy, Tatiana Clouthier, pointing out that the changes in energy policies constitute a violation of core obligations such as the principle of non-discrimination provided for in the U.S.-Mexico-Canada Agreement (USMCA).

In that letter, the USTR highlighted the enormous and important investment that U.S. companies have in Mexico’s electricity sector, reaching approximately $10 billion. USTR Tai also mentioned that the U.S. would use all legal measures available in the USMCA to “address the concerns” of the U.S. government.

According to the National Renewable Energy Laboratory, the rejected constitutional amendment would have required that the Mexican SOE have much greater participation in the electricity market; by some estimates, its contribution could have soared to 74% while the private sector’s participation would have fallen from 60% to 26%, affecting the region’s competitiveness and value chains.

Mexico did not include the Electricity Industry Law in its USMCA list or annex of “non-conforming measures” on cross-border investment and services. However, USMCA Article 32.11 allowed Mexico to “reserve” measures that were compatible with reservations made in other trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). Like recent energy policies, the constitutional amendment initiative was widely questioned as incompatible with Mexico’s international commitments. This is because Mexico’s reservations in CPTPP merely reflect the objectives of the 2014 energy amendment, which created a “level playing field” for private companies vis-a-vis SOEs (e.g. CFE) and promoted the use of clean energy.

Finally, the recent amendment of the Mining Law and restrictions on the “exploitation” of lithium is also highly questionable in light of the USMCA and other trade agreements. Obviously, the exploitation of lithium by an SOE is not foreseen as a “non-conforming measure” in the USMCA or in a reservation established in another free trade agreement.

At VTZ we note that the U.S. government is closely following legal and judicial developments in Mexican energy matters. The USTR’s Trade Barriers Report 2022 included an “energy” section of Mexico, mentioning that the Mexican Supreme Court would review the constitutionality of the recent amendments of the Electricity Industry Law (LIE) (in this regard, we inform readers that the Supreme Court did not declare the reform to the LIE unconstitutional in its April 7, 2022, plenary hearing).

While it is true that no changes to the constitution were approved and that institutional checks and balances can still correct its energy policies, it is also true that Mexico is taking a controversial path. By placing restrictions on the exploitation of lithium, an essential mineral for advanced batteries and a key input to value chains considered “strategic” for the United States, Mexico continues to provoke its main trading partner.

In that sense, it may be a matter of time before the USTR activates the dispute settlement mechanism, and that Mexico may face the eventual risk that the United States “suspend benefits” to Mexican goods.